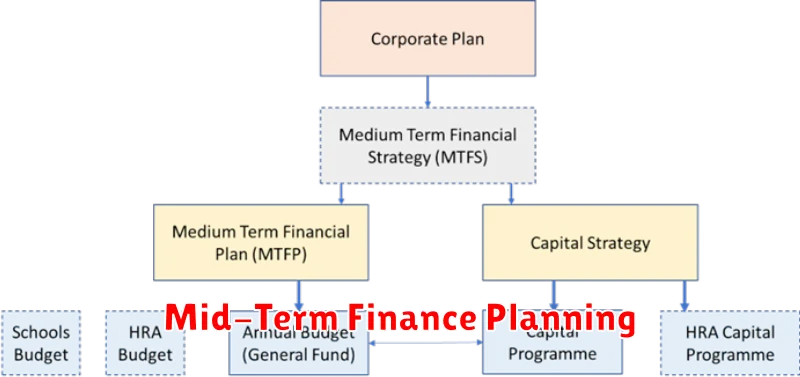

In the realm of personal finance, a well-defined roadmap is essential for achieving your financial goals. A five-year financial plan is more than just a document; it’s a dynamic tool that empowers you to navigate the complexities of your financial life. It provides a strategic framework for managing your income, expenses, investments, and savings, enabling you to make informed decisions and build a secure financial future. Understanding why your 5-year financial plan matters is crucial for taking control of your finances and maximizing your potential for long-term financial success. This plan helps you anticipate financial challenges, capitalize on opportunities, and ensure you’re on track to meet your long-term financial goals, making it more critical than you might think.

A 5-year financial plan is a comprehensive roadmap outlining your financial goals and the strategies you’ll use to achieve them over the next five years. It’s a dynamic document that helps you visualize your financial future, make informed decisions, and stay on track toward your objectives.

This plan typically encompasses various aspects of your finances, including saving, investing, debt management, and retirement planning. It involves setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, such as buying a home, paying off student loans, or accumulating a certain amount of retirement savings.

By forecasting your income and expenses, a 5-year financial plan helps you allocate resources effectively and prioritize your financial objectives. It also allows you to anticipate potential challenges and develop contingency plans to address unforeseen circumstances.

While a 5-year timeframe provides a reasonable outlook, your plan should be reviewed and adjusted annually to reflect changes in your financial situation, market conditions, and life goals. This regular review ensures your plan remains relevant and effective in guiding your financial decisions.

Identify Your Core Life and Money Goals

A crucial first step in creating a 5-year financial plan is identifying your core life and money goals. What do you truly want to achieve in the next five years? Think both big and small. Do you want to buy a house? Start a family? Travel the world? Pay off debt? These aspirations form the foundation of your plan.

Clearly defined goals provide direction and motivation. They transform abstract wishes into concrete targets. Write them down and be specific. Instead of “save more money,” aim for “save $10,000 for a down payment.” The more specific you are, the easier it is to track progress and stay motivated.

Consider both short-term and long-term goals within that five-year timeframe. Some goals might be achievable within a year or two, while others might require the full five years. This blend ensures a balance of quick wins and sustained progress towards larger ambitions. Prioritize your goals based on their importance and urgency. Which ones are most critical to your overall happiness and well-being?

Finally, ensure your financial goals align with your life goals. Your finances should support your desired lifestyle, not dictate it. For example, if your goal is to travel extensively, prioritize saving for travel expenses and potentially consider career options that offer flexibility.

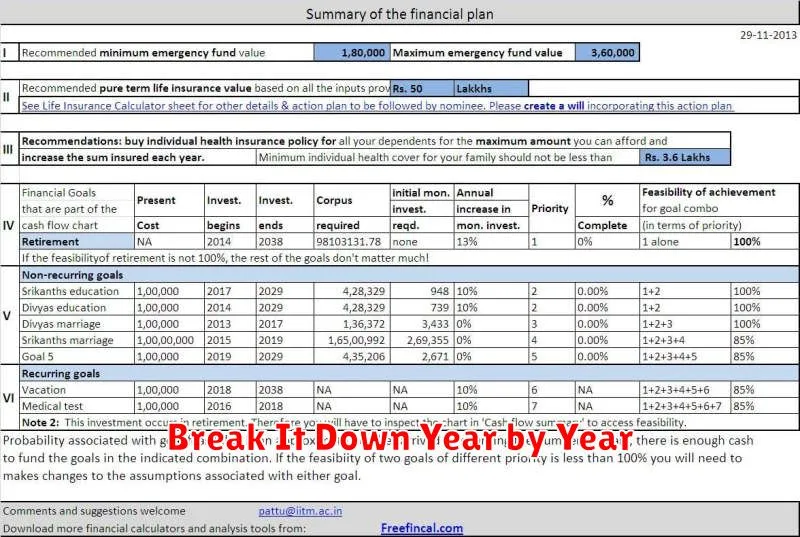

Break It Down Year by Year

A five-year financial plan isn’t about rigidly predicting the future. It’s about setting measurable goals and creating a flexible roadmap. Breaking it down year by year allows for adjustments and keeps you focused on the bigger picture.

Year One is typically focused on establishing a strong foundation. This might include paying down high-interest debt, building an emergency fund, or increasing retirement contributions. It’s about setting the stage for future growth.

Years Two and Three often involve building upon that foundation. You might consider increasing investments, exploring new income streams, or saving for a significant purchase like a down payment on a house or a car. This period is about consistent progress towards your long-term goals.

Years Four and Five allow you to refine your strategy based on your progress and changing circumstances. Perhaps you’re closer to a major life event, like retirement or starting a family. This phase is about adaptability and ensuring your plan still aligns with your evolving needs and priorities.

By breaking down your five-year plan into yearly increments, you can track your progress, celebrate milestones, and make necessary adjustments. This approach allows for greater flexibility and increases the likelihood of achieving your financial objectives.

Include Career, Family, and Major Expenses

A crucial aspect of a successful 5-year financial plan involves considering your career trajectory, family plans, and anticipated major expenses. These elements significantly impact your financial stability and your ability to reach your long-term goals.

Career: Projecting your career path over the next five years helps estimate potential income growth. Factor in potential promotions, raises, or even a career change. This projection informs your savings and investment strategies. Will you need further education or training to advance? Include these costs in your plan.

Family: Anticipating changes in your family structure is essential. Marriage, having children, or caring for aging parents will significantly influence your financial needs and priorities. Consider childcare costs, increased healthcare expenses, or potential adjustments to your living situation.

Major Expenses: Identify significant anticipated expenses within the next five years. This might include a down payment on a house, purchasing a car, or funding a major home renovation. Planning for these expenses allows you to save strategically and avoid accruing unnecessary debt.

Set Annual Saving and Investing Milestones

A crucial aspect of a successful five-year financial plan involves setting annual milestones for both saving and investing. These milestones provide measurable targets that keep you on track towards your larger financial goals.

Begin by determining your desired net worth at the end of the five-year period. Then, work backward, breaking down the overall growth into incremental annual targets. This approach allows you to see how much you need to save and invest each year to reach your ultimate objective.

Consider factors like your current income, expenses, and expected return on investments when setting these milestones. Be realistic in your projections, accounting for potential market fluctuations and life events that may impact your financial situation.

Regularly review and adjust your milestones as needed. Life changes, such as a salary increase or unexpected expenses, can require adjustments to your savings and investment targets. This ensures your plan remains relevant and effective in helping you achieve your long-term financial objectives.

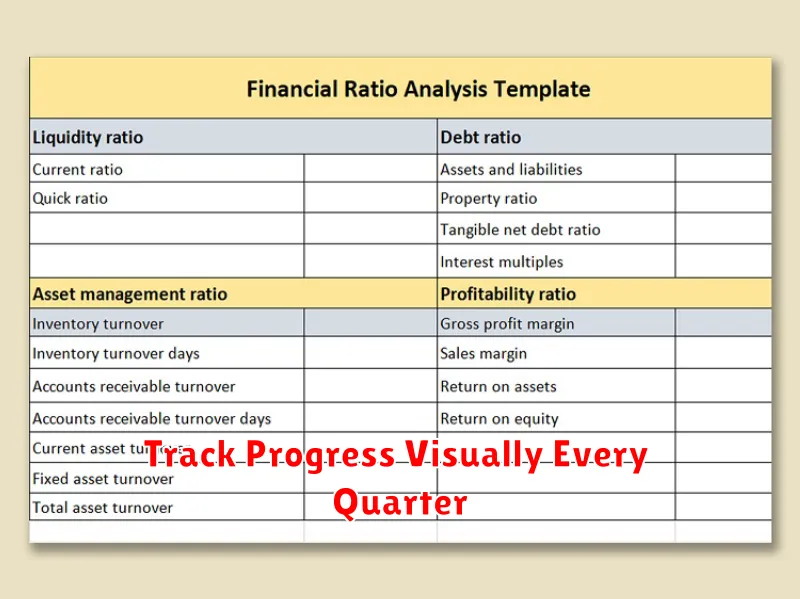

Track Progress Visually Every Quarter

A critical aspect of a successful five-year financial plan is regular monitoring and evaluation. Tracking your progress visually every quarter allows you to stay engaged with your plan and make necessary adjustments. Charts and graphs can provide a clear picture of your progress towards key financial goals, such as retirement savings, debt reduction, or investment growth.

Visualizing your progress can also be a powerful motivational tool. Seeing tangible evidence of your accomplishments can reinforce positive financial behaviors and encourage you to stay committed to your long-term objectives. Conversely, if you’re falling behind on certain goals, quarterly visual tracking provides an early warning system, allowing you to identify areas needing attention and course-correct before small deviations become major setbacks.

Consider using spreadsheets, budgeting apps, or financial dashboards to track your progress. These tools can help you visualize your financial data in various formats, such as line graphs for investment growth, bar charts for debt reduction, or pie charts for asset allocation. By reviewing these visualizations every quarter, you gain valuable insights into the effectiveness of your strategies and make informed decisions about your financial future. This consistent monitoring is crucial for ensuring your five-year plan remains relevant and adaptable to life’s inevitable changes.

Update the Plan Based on Life Shifts

Life rarely goes exactly as planned. A five-year financial plan isn’t meant to be static. It needs to be a living document that adapts to your evolving circumstances. Major life changes necessitate adjustments to your financial strategy.

Marriage, divorce, the birth of a child, a career change, or the death of a loved one – these events all significantly impact your financial landscape. They can alter your income, expenses, and long-term goals. For example, having a child may lead to increased childcare costs and necessitate adjustments to your savings strategy for college education. A career change might involve a salary increase or decrease, requiring you to revise your budget and investment plans accordingly.

Regularly review and revise your plan. Aim for an annual review, but be prepared to reassess more frequently if significant changes occur. This ensures your financial plan remains relevant and effective in helping you achieve your goals despite life’s inevitable shifts.