In today’s volatile economic climate, safeguarding your financial stability is paramount. Inflation can erode your purchasing power and derail your financial goals if left unchecked. This article will provide actionable strategies on how to future-proof your budget against inflation, covering key areas such as investing, saving, debt management, and income generation. Learn how to build a resilient budget that can withstand inflationary pressures and protect your financial future. Understand the impact of inflation on your budget and gain the knowledge to take control of your finances, no matter the economic conditions.

Understand How Inflation Affects Everyday Costs

Inflation is a general increase in the price of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

Reduced Purchasing Power is a key effect of inflation. As prices rise, your money buys less. This means a fixed amount of money will afford you fewer groceries, less gasoline, and other essential goods and services.

Impact on Different Spending Categories. Inflation doesn’t affect all goods and services equally. Some items, like food and energy, can experience more dramatic price increases than others. This can significantly impact household budgets, particularly for lower-income families who spend a larger proportion of their income on these necessities.

Erosion of Savings. While the nominal value of your savings may remain the same, inflation erodes the real value of those savings. If the rate of inflation is higher than the interest rate on your savings account, the purchasing power of your savings is diminishing over time.

Understanding how inflation affects your everyday costs is crucial for making informed financial decisions and adjusting your budget to maintain your standard of living.

Create a Buffer in Each Spending Category

Inflation can significantly impact your budget, causing prices to rise unexpectedly. One effective strategy to mitigate this risk is to build a buffer into each spending category.

Evaluate your current spending in categories like groceries, transportation, utilities, and entertainment. Determine where you might be able to reduce spending slightly, even by a small percentage.

Allocate the saved amounts to create a buffer within each category. This buffer acts as a cushion against price increases. For example, if your monthly grocery budget is $500, aim to reduce it to $480 and add the $20 to your grocery buffer.

Regularly review and adjust your buffers. As inflation fluctuates, so should your buffer amounts. Periodically reassess your spending and adjust the buffers accordingly to ensure continued protection against rising prices.

Consider prioritizing essential categories like food and housing when allocating buffer funds. These are typically the areas most impacted by inflation and therefore require greater protection. While having buffers in all categories is ideal, focus on essentials first.

By implementing these strategies, you can create a more resilient budget that can withstand the unpredictable nature of inflation and help maintain your financial stability.

Review Subscriptions and Services Yearly

Inflation can significantly impact the cost of recurring subscriptions and services. A yearly review helps you stay ahead of these rising costs and ensure you’re getting the best value for your money. This proactive approach is crucial for future-proofing your budget.

Start by creating a comprehensive list of all your subscriptions, including streaming services, gym memberships, software subscriptions, and magazine subscriptions. Analyze each one, asking yourself: Do I still use this service regularly? Is the value I’m receiving still worth the price? Are there cheaper alternatives available? Can I bundle services for a discount? Could I share a subscription with someone?

Negotiating lower prices is also a valuable tactic. Contact providers directly and inquire about potential discounts or promotions. You might be surprised at their willingness to retain your business by offering a lower rate. Don’t be afraid to cancel services you don’t use or find too expensive. Remember, every dollar saved contributes to a stronger financial foundation.

Invest in Assets That Outpace Inflation

Inflation erodes the purchasing power of your money over time. To counteract this, it’s crucial to invest in assets that have the potential to grow at a rate higher than the inflation rate. This helps preserve and even grow the real value of your savings.

Several asset classes can offer this potential, although they come with varying levels of risk. Equities, or stocks, historically have delivered returns that outpace inflation over the long term. However, they can also experience significant short-term volatility. Real estate is another potential inflation hedge, as property values and rents tend to rise with inflation. Commodities, such as precious metals like gold and silver, or other raw materials, can also serve as a store of value during inflationary periods.

Diversification is key. Don’t put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk and potentially maximize returns. Consider consulting with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

Adjust Budget Annually Based on Inflation Rate

Inflation erodes purchasing power over time. To maintain your standard of living and ensure your budget remains effective, it’s crucial to adjust it annually based on the current inflation rate. This proactive approach prevents your expenses from outpacing your income.

Begin by reviewing your current budget in detail. Identify essential expenses like housing, food, and transportation. Then, research the current inflation rate. Several reliable sources provide this information, including government agencies and financial institutions.

Apply the inflation rate to your essential expenses. For example, if inflation is 3% and your monthly grocery bill is $500, you should anticipate spending an additional $15 next year ($500 x 0.03 = $15). Adjust your budget accordingly for each expense category.

While adjusting for inflation annually is a strong starting point, consider reviewing and adjusting your budget more frequently, especially during periods of high or unpredictable inflation. This allows for more precise adjustments and helps maintain financial stability.

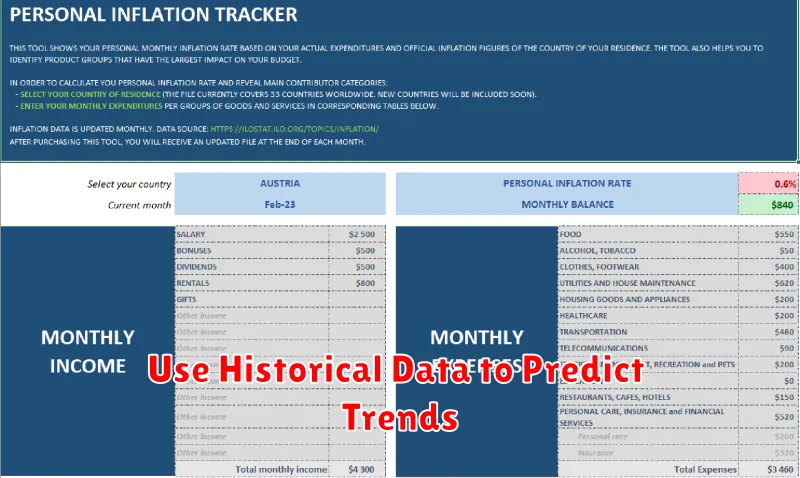

Use Historical Data to Predict Trends

Analyzing historical inflation data provides valuable insights for future budget planning. By examining past trends in the Consumer Price Index (CPI), you can gain a stronger understanding of how various expense categories, such as housing, food, and transportation, have fluctuated over time. This historical perspective can offer a baseline for anticipating potential future increases.

While past performance is not a guarantee of future results, it can inform realistic expectations. For example, if the cost of groceries has historically increased by an average of 3% annually, you can incorporate a similar increase into your future budget projections. This proactive approach allows for more accurate budgeting and minimizes the impact of unexpected price hikes.

It’s crucial to consider long-term trends as well as shorter-term fluctuations. While recent data might show a spike in inflation, a broader historical view can reveal whether this is an anomaly or part of a larger pattern. Combining this historical analysis with current economic indicators provides a more comprehensive picture for informed budget adjustments.

Cut Recurring Luxuries That No Longer Serve Value

Inflation necessitates a thorough review of expenses. A key strategy for future-proofing your budget is to identify and eliminate recurring luxury expenses that no longer provide sufficient value. These are often subscription services, entertainment costs, or habitual purchases that have become ingrained in your routine but don’t align with your current financial goals.

Begin by listing all your recurring expenses. Scrutinize each item, asking yourself if the value it brings justifies the cost in the context of rising prices. For example, that premium cable package might be excessive if you primarily use streaming services. Similarly, frequent restaurant meals or that gym membership you rarely utilize could be significant drains on your resources.

Prioritize needs over wants. Distinguishing between essential expenses and discretionary luxuries is crucial. While some luxuries contribute to wellbeing, others can be temporarily suspended or replaced with more affordable alternatives. Consider swapping that expensive coffee shop habit for home-brewed coffee, or exploring free or low-cost recreational activities instead of pricey entertainment venues.

Cutting recurring luxuries doesn’t necessarily mean sacrificing enjoyment. It’s about making conscious choices that align with your financial objectives and finding cost-effective ways to maintain your lifestyle. By redirecting funds from non-essential luxuries to savings or debt reduction, you’ll be better equipped to navigate inflationary pressures and achieve long-term financial security.