Are you dreaming of a big financial future but feeling overwhelmed by the enormity of it all? The secret to achieving significant financial success often lies in starting small. This article explores the key reasons why adopting a “start small” approach can unlock your big financial potential, paving the way for lasting wealth and financial security. We will delve into the power of compounding, the importance of building strong financial habits, and how seemingly insignificant steps can lead to remarkable long-term gains, ultimately demonstrating why starting small is the key to a big financial future.

The Psychology of Small Wins

Small wins play a crucial role in building momentum towards larger financial goals. They provide a sense of progress and achievement, which fuels motivation and encourages continued effort. This positive feedback loop is essential, especially when pursuing long-term objectives like financial security.

Each small victory, whether it’s saving a small amount of money, paying off a small debt, or learning a new financial skill, triggers the release of dopamine, a neurotransmitter associated with pleasure and reward. This reinforces the positive behavior, making it more likely to be repeated.

Furthermore, small wins combat feelings of overwhelm and helplessness that can often accompany large, daunting goals. By breaking down a large objective into smaller, manageable steps, the overall process feels less intimidating and more achievable. This increased sense of self-efficacy – the belief in one’s ability to succeed – is a powerful driver of continued progress.

The psychology of small wins also counters the negative impact of setbacks. When facing inevitable challenges, the memory of previous successes provides resilience and the determination to persevere. These small victories serve as tangible reminders of progress made, preventing discouragement and maintaining forward momentum.

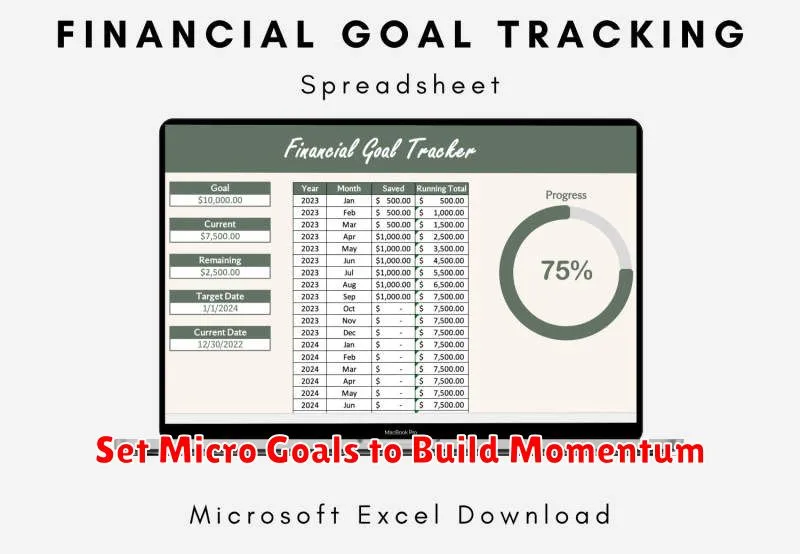

Set Micro Goals to Build Momentum

Building a secure financial future can feel overwhelming. Often, the sheer scale of long-term goals, like retirement or buying a house, can be paralyzing. This is where the power of micro goals comes in. These small, achievable steps create a sense of momentum and forward progress that fuels continued effort.

Instead of focusing solely on saving a large sum, break it down. A micro goal might be saving $50 extra this week, bringing lunch to work three times next week, or canceling one unused subscription. These small wins, though seemingly insignificant on their own, accumulate over time and contribute significantly to larger financial objectives.

The psychology behind this is crucial. Each achieved micro goal provides a sense of accomplishment. This boosts confidence and reinforces the positive behaviors needed for long-term success. It’s a cycle of positive reinforcement: small wins lead to increased motivation, which leads to further progress, and ultimately, to achieving those larger financial aspirations.

Micro goals also offer flexibility and adaptability. Life throws curveballs. Large, rigid goals can be easily derailed by unexpected expenses or changes in income. Micro goals, being smaller and more manageable, can be adjusted more easily to accommodate these changes, keeping you on track towards your overall financial vision.

Save Small But Regularly (Daily/Weekly)

The cornerstone of building a secure financial future often isn’t about making large, infrequent contributions. Rather, it’s about the power of consistency. Saving small amounts regularly, whether daily or weekly, fosters financial discipline and allows the principle of compound interest to work its magic. Even small amounts accumulate significantly over time.

Think of it like building a muscle. You wouldn’t expect significant growth from one intense workout. Similarly, financial growth is best achieved through consistent, smaller efforts. A daily $5 coffee saved becomes $150 a month, and over a year, that’s $1,800. These small, regular savings build a foundation for larger future investments and provide a safety net against unexpected expenses.

Automating these small, regular savings is a powerful tool. Set up a daily or weekly transfer to a separate savings account. You’ll be surprised how these small amounts add up over time, building a solid financial base without significantly impacting your current lifestyle.

Invest in Simple, Low-Risk Accounts First

When beginning your investment journey, prioritize simplicity and low-risk options. This allows you to build a solid foundation and gain experience without exposing your capital to excessive volatility.

Consider starting with a high-yield savings account. These accounts offer a higher interest rate than traditional savings accounts, helping your money grow steadily while remaining easily accessible. Another excellent starting point is a certificate of deposit (CD). CDs offer a fixed interest rate for a specified period, providing predictable returns.

For retirement savings, explore a Roth IRA or Traditional IRA. These accounts offer tax advantages and encourage long-term savings. Contributing even small amounts regularly can significantly impact your future financial security.

Focusing on these low-risk options initially allows you to become comfortable with the process of investing and gain confidence before exploring more complex investment vehicles.

Track and Celebrate 1% Improvements Monthly

Small, consistent improvements are the bedrock of significant long-term financial growth. Tracking and celebrating these small wins is crucial for maintaining momentum and building positive financial habits. A 1% monthly improvement might seem insignificant, but compounded over time, it yields substantial results.

Begin by identifying key areas for improvement. This could be increasing your monthly savings rate, reducing discretionary spending, or negotiating a lower interest rate on debt. Once identified, set a realistic 1% improvement goal for each area.

Tracking your progress is essential for accountability. Utilize budgeting apps, spreadsheets, or even a simple notebook to monitor your performance. This allows you to visualize your advancements and identify areas requiring further attention.

Celebrating milestones, no matter how small, reinforces positive behavior. Acknowledge your achievements, whether it’s successfully sticking to your budget for a month or reaching a savings goal. This positive reinforcement helps solidify the habit and keeps you motivated on your journey to a secure financial future.

Be Consistent More Than Perfect

In the pursuit of a secure financial future, many individuals get caught up in the idea of needing a perfect plan or a large sum of money to begin. This can lead to inaction and procrastination. The truth is, consistency trumps perfection. Small, regular contributions made consistently over time have a far greater impact than sporadic, larger deposits.

Think of it like building a muscle. You wouldn’t expect to achieve significant gains by lifting heavy weights once a month. Similarly, your finances benefit more from regular, manageable contributions, even if they seem small. This consistent effort allows you to build the habit of saving and investing, laying a solid foundation for long-term growth.

Don’t strive for the “perfect” investment strategy or wait for the “perfect” time to start. Focus on making consistent progress, even if it’s just a small amount each week or month. This disciplined approach, combined with the power of compounding, will set you on the path toward a big financial future.

Let Compounding Do the Heavy Lifting

Compounding is the secret weapon of long-term financial growth. It’s the process where your earnings generate even more earnings. Think of it like a snowball rolling downhill, gathering more snow and momentum as it goes. When you reinvest your returns, those returns generate their own returns, and the cycle continues, creating exponential growth over time.

Even small initial investments can grow substantially with the power of compounding. The key is to start early and remain consistent. Time is your greatest ally in this process, allowing your returns to compound repeatedly. The longer your money is invested, the more dramatic the effect of compounding becomes.

Don’t underestimate the impact of seemingly small gains compounded over many years. Patience and discipline are crucial to harnessing the full potential of compounding. By consistently reinvesting your returns and allowing your investments to grow undisturbed, you’ll be surprised at the substantial wealth you can accumulate over the long term.