Life’s major transitions, such as marriage, having children, buying a home, changing careers, or retirement, often necessitate significant financial adjustments. Preparing your finances for these major life changes is crucial for navigating these transitions smoothly and securing your financial future. This article will provide you with essential guidance on how to effectively prepare your finances for upcoming life changes, covering topics like budgeting, saving, investing, and risk management, empowering you to face the future with confidence and financial stability. We’ll explore practical steps to take to ensure your financial well-being amidst these major life changes, helping you to make informed decisions and achieve your financial goals.

Identify Upcoming Changes (Marriage, Kids, Career)

The first step in preparing your finances for major life changes is to identify what those changes might be. While the future is uncertain, considering likely scenarios can greatly assist your planning. Are you anticipating marriage in the near future? Marriage often brings combined finances, shared expenses, and potentially new financial goals like buying a home. Planning for these shifts is essential.

Children bring significant financial responsibilities. From diapers and daycare to education and extracurricular activities, costs can quickly accumulate. Thinking ahead about family planning helps establish savings goals and adjust your budget accordingly. Even if parenthood isn’t imminent, considering its potential impact on your finances is prudent.

Career changes, whether voluntary or unexpected, can impact your income stream. A promotion might mean a higher salary, while a job loss could lead to financial strain. Consider your career trajectory. Are you planning to pursue further education, which might require loans or a period of reduced income? Could a career switch lead to higher earning potential or greater job security? Factor these possibilities into your financial planning.

By proactively identifying these potential life changes, you can begin to develop a financial strategy that accommodates their impact. This foresight enables you to make informed decisions about budgeting, saving, and investing, providing greater financial stability and preparedness for the future.

Build a Flexible Budget That Adapts Easily

Life changes, often unexpectedly. A flexible budget is your strongest financial tool in navigating these shifts. Flexibility doesn’t mean neglecting planning. It means creating a budget that bends without breaking.

Start by categorizing your expenses: needs, wants, and savings. Needs are essential (housing, food, transportation). Wants are enjoyable but non-essential (dining out, entertainment). Savings are crucial for future goals and emergencies. Assign percentages to each category.

Next, incorporate adjustable spending limits. For example, your “wants” category can have a higher limit during stable times, but you should be prepared to significantly reduce it when facing a change like a job loss or new family member. This requires honest assessment of what truly matters and where cuts can be made without drastically impacting your wellbeing.

Regularly review and adjust your budget. A monthly check-in allows you to track spending, identify areas of overspending, and reallocate funds as needed. This proactive approach ensures your budget remains aligned with your current circumstances and evolving financial goals.

Building flexibility also involves creating a financial cushion. An emergency fund provides a safety net during unexpected events, minimizing the need to rely on debt or drastically alter your lifestyle. Aim for 3-6 months of essential expenses.

Save in Advance for Known Big Costs

Major life changes often come with significant financial implications. Planning ahead and saving in advance for known big costs can greatly reduce stress and improve your financial stability during these transitions.

Anticipate expenses. Think about the predictable costs associated with the life change. Is it a wedding? A new baby? Retirement? List out all the expected expenses, from big-ticket items to smaller, recurring costs.

Create a savings plan. Once you have a grasp of the potential expenses, establish a realistic savings plan. Determine how much you need to save and establish a timeline for reaching your goal. Consider setting up a dedicated savings account specifically for this purpose.

Prioritize saving. Treat saving for these known costs as a non-negotiable expense. Evaluate your budget and identify areas where you can reduce spending to free up more money for savings.

Automate savings. Set up automatic transfers from your checking account to your savings account each month. This helps ensure consistent saving progress without requiring constant manual effort.

Review and adjust. Periodically review your savings progress and adjust your plan as needed. Life circumstances and expenses can change, so maintaining flexibility in your savings strategy is essential.

Research Costs Associated With Life Events

Planning for major life changes requires understanding their potential financial impact. Researching costs associated with these events is crucial for building a secure financial future. This research allows for informed decision-making and helps avoid unexpected financial strain.

Significant life events often come with considerable expenses. For example, the cost of having a child includes prenatal care, delivery, and ongoing expenses like diapers, formula, and childcare. Buying a home necessitates a down payment, closing costs, and potential ongoing repairs. Getting married can entail the expense of the wedding itself as well as the combined living expenses afterward.

Thoroughly investigating the potential costs associated with these life changes is essential. Utilize online resources, consult with financial advisors, and talk to friends and family who have experienced similar events. Gathering information from multiple sources provides a comprehensive understanding of the financial landscape.

By proactively researching these costs, you can effectively prepare your finances for the future. This preparation may involve building an emergency fund, adjusting your budget, or investing in long-term savings plans. Ultimately, understanding the potential financial implications allows you to make informed choices and navigate life’s transitions with greater financial security.

Avoid Major Financial Moves During Transition

Periods of significant life change often bring emotional upheaval. This can cloud judgment, making it difficult to make sound financial decisions. Therefore, it’s generally wise to avoid making any major financial moves during these transitional times. This includes large purchases like a new house or car, significant investments such as starting a business, or selling off assets unless absolutely necessary.

Focus on stabilizing your finances during the transition. Create or revise your budget to reflect your current situation. Prioritize essential expenses and identify areas where you can cut back. This period is a time for careful evaluation and planning, not impulsive financial decisions. Making rash moves during a time of flux can exacerbate stress and potentially lead to long-term financial difficulties.

Instead of making large changes, concentrate on gathering information and seeking professional advice. Consult with a financial advisor who can offer objective guidance tailored to your specific circumstances. Once you’ve navigated the transition and have a clearer understanding of your new financial landscape, you can make more informed decisions about your long-term financial goals.

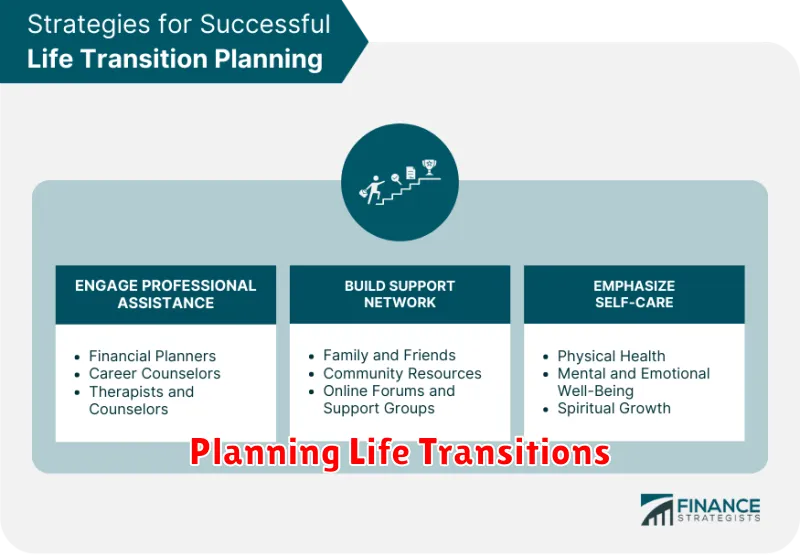

Consult Financial Advisors If Needed

Navigating major life changes often requires adjusting your financial plan. While you can handle some adjustments independently, others may benefit from professional guidance. Consider consulting a financial advisor if you’re facing complex financial situations, such as significant changes to your income, large inheritances, or divorce.

A financial advisor can provide personalized advice tailored to your specific circumstances. They can help you assess your current financial situation, project future needs, and develop a comprehensive financial plan to address those needs. This can include strategies for budgeting, investing, tax planning, and estate planning.

Choosing the right financial advisor is crucial. Look for a certified financial planner (CFP) or a similar credential. Interview several advisors to ensure their expertise aligns with your needs and that you’re comfortable with their communication style and fee structure.

Review and Revise Goals After Each Change

Life changes often necessitate adjustments to financial goals. After a major life event, take time to review your existing financial plan. Consider how the change impacts your income, expenses, and overall financial stability.

Revision is key. Your previous goals may no longer be realistic or aligned with your new circumstances. For example, a new job with a higher salary might allow you to accelerate your retirement savings, while a job loss might require you to temporarily scale back on certain financial objectives.

Don’t be afraid to adjust your budget, re-evaluate your investments, and prioritize your financial goals based on your current situation. This process of ongoing review and revision will help you maintain financial stability and adapt to life’s unpredictable nature.