Planning for a secure retirement can feel overwhelming, but building a reliable retirement plan is achievable with the right approach. This article will guide you through the essential steps to create a retirement plan you can rely on, covering topics like retirement savings, investment strategies, and retirement income planning, empowering you to confidently navigate your journey towards a comfortable and fulfilling retirement.

Why You Shouldn’t Wait to Start Planning

Retirement planning is often seen as something for the distant future, but delaying the process can significantly impact your financial security. The power of compounding is a crucial element in building a robust retirement nest egg. The earlier you begin investing, the more time your money has to grow exponentially. Even small contributions made consistently over a long period can accumulate substantial returns, thanks to the compounding effect of earning returns on your initial investments as well as on accumulated interest.

Procrastination can lead to a much larger savings burden later on. Waiting means needing to contribute significantly more each month to catch up, potentially straining your budget and limiting your lifestyle choices in the present. Starting early allows you to spread your contributions over a longer timeframe, making the process more manageable and less disruptive to your current financial situation.

Additionally, starting early provides more time to adjust your strategy. Life throws curveballs, and your financial situation can change unexpectedly. Early planning provides flexibility to adapt to these changes, whether it’s a career shift, a growing family, or unforeseen expenses. You’ll have more time to make necessary adjustments to your investment portfolio and savings goals without drastically altering your retirement outlook.

Finally, early planning gives you peace of mind. Knowing you’re actively working towards a secure retirement reduces financial stress and allows you to focus on other important aspects of your life. This proactive approach fosters confidence and empowers you to make informed decisions about your future. Don’t let procrastination rob you of the opportunity to build a solid foundation for a comfortable and enjoyable retirement.

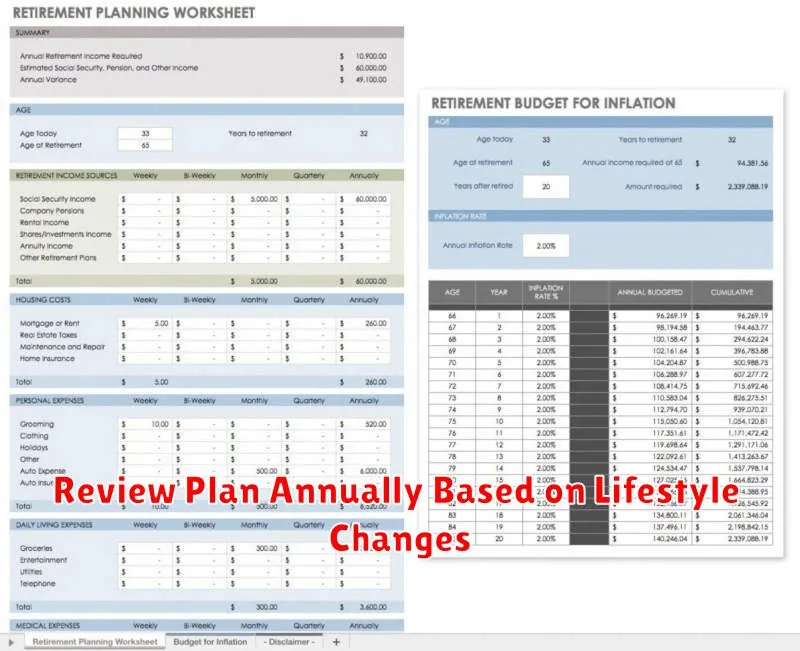

Estimate How Much You’ll Need at Retirement

Estimating your retirement needs is a crucial step in building a secure financial future. While there’s no one-size-fits-all answer, a common rule of thumb suggests aiming for 80% of your pre-retirement income. This assumes a decrease in certain expenses, such as commuting and work-related costs.

However, your individual needs may vary. Consider your anticipated lifestyle in retirement. Will you be traveling extensively? Do you have hobbies that require significant spending? Healthcare costs are another significant factor, and these tend to increase with age. Be realistic about potential medical expenses, including long-term care.

Creating a detailed budget of your expected retirement expenses is essential. List all anticipated costs, from housing and food to leisure activities and medical care. This will provide a clearer picture of your financial requirements. Don’t forget to account for inflation, which can erode your purchasing power over time.

Finally, remember that this is just an estimate. It’s wise to regularly review and adjust your retirement plan as your circumstances change. Consulting with a financial advisor can provide personalized guidance and help you create a plan tailored to your specific goals and needs.

Start Small but Stay Consistent

Building a secure retirement doesn’t require a massive initial investment. What’s far more critical is establishing a consistent saving habit, even if you begin with small amounts.

The power of compound interest allows even modest regular contributions to grow significantly over time. Starting early, even with small amounts, allows your investments more time to grow and compound.

Prioritize consistency over large, sporadic contributions. Set up an automatic transfer from your checking account to your retirement account each month. Even a small, consistent amount builds momentum and creates a strong foundation for your retirement savings.

Don’t get discouraged if you can’t contribute a large sum initially. Focus on building the habit of saving regularly. As your income increases, you can gradually increase your contributions. Small, consistent efforts over the long term can yield substantial results.

Understand the Power of Compound Growth

Compound growth is the cornerstone of a successful retirement plan. It’s the principle where your investment earnings generate their own earnings over time. This snowball effect can dramatically increase your wealth, especially over the long term.

Imagine investing $1,000 today with a 7% annual return. In the first year, you earn $70. The next year, you earn 7% not just on the original $1,000, but on $1,070, resulting in slightly more than $70 in interest. This seemingly small difference becomes incredibly significant over decades. The longer your money compounds, the more exponential the growth.

To harness this power, start investing early and consistently. Even small contributions made regularly can accumulate substantially over time thanks to compounding. Prioritize investments with the potential for long-term growth, such as stocks or mutual funds.

It’s essential to understand the relationship between time, return rates, and the amount you invest. Each factor plays a crucial role in determining the ultimate growth of your retirement savings. Utilize a compound interest calculator to visualize the impact of these variables and tailor your strategy accordingly. This allows you to project potential future growth based on different scenarios and adjust your savings plan as needed.

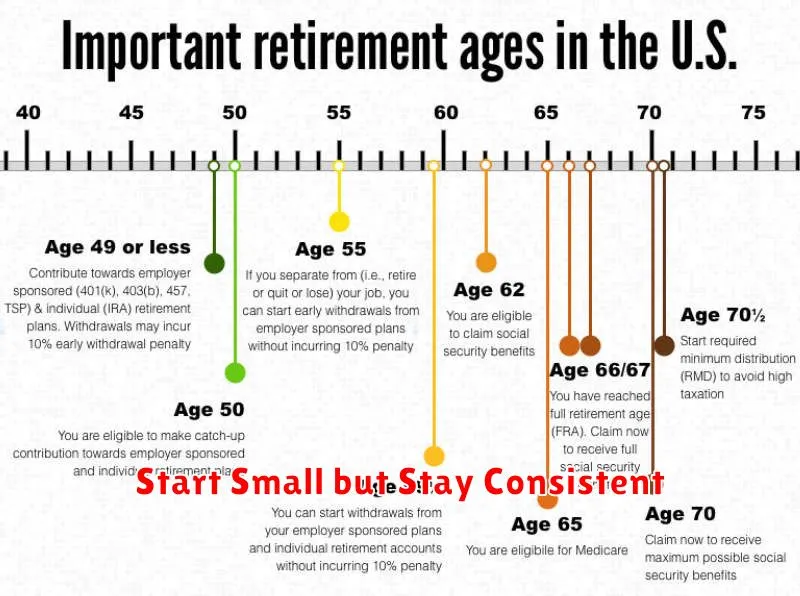

Choose the Right Retirement Vehicles for You

Selecting the right retirement vehicles is crucial for building a secure financial future. Understanding the various options and their benefits will help you make informed decisions tailored to your individual needs.

401(k) or 403(b) plans are employer-sponsored plans that offer tax advantages and often include employer matching contributions. These plans allow pre-tax contributions, reducing your current taxable income. Investing in these plans early allows your earnings to grow tax-deferred, compounding over time.

Traditional IRAs and Roth IRAs are individual retirement accounts offering different tax benefits. Traditional IRAs provide tax deductions on contributions, while Roth IRAs offer tax-free withdrawals in retirement. Consider your current and projected tax bracket when deciding which option is best for you.

SEP IRAs and SIMPLE IRAs are designed for self-employed individuals and small business owners. These plans offer tax-deferred growth and higher contribution limits than traditional or Roth IRAs, allowing for greater savings potential.

Annuities are contracts with insurance companies that provide guaranteed income streams in retirement. While they offer security, they often come with higher fees and less liquidity compared to other retirement vehicles. Carefully evaluate the terms and conditions before investing in an annuity.

Choosing the right combination of retirement vehicles is a personalized decision. Consider your employment status, risk tolerance, and long-term financial goals. Consulting with a qualified financial advisor can help you create a diversified retirement portfolio that aligns with your specific circumstances.

Review Plan Annually Based on Lifestyle Changes

A retirement plan isn’t a “set it and forget it” endeavor. Life is dynamic, and your retirement plan should be too. Annual reviews are crucial for ensuring your plan remains aligned with your evolving lifestyle and financial circumstances.

Consider major life changes that may impact your retirement needs. Marriage, divorce, the birth of a child, or the purchase of a new home can significantly alter your financial landscape. These events often require adjustments to your savings rate, investment strategy, or even your projected retirement date.

Beyond major life events, regularly evaluate your spending habits and overall financial health. Are your expenses increasing? Have you received an unexpected inheritance? These seemingly smaller shifts can still necessitate modifications to your plan.

During your annual review, reassess your risk tolerance. As you get closer to retirement, you may want to shift towards a more conservative investment portfolio to protect your accumulated savings. Conversely, a younger individual might be comfortable with a higher risk approach.

Finally, don’t hesitate to consult with a financial advisor. They can provide personalized guidance, help you navigate complex financial decisions, and ensure your retirement plan remains on track to meet your evolving needs.

Talk to a Certified Advisor When Necessary

Building a solid retirement plan often requires more than just personal research. While online resources and tools can be helpful starting points, they may not address your specific circumstances and needs. Complex financial situations, such as significant investment portfolios, business ownership, or inheritance planning, often benefit from professional guidance.

A certified financial advisor can provide personalized advice tailored to your goals, risk tolerance, and financial situation. They can help you navigate complex financial products, minimize tax implications, and develop a comprehensive strategy for accumulating and managing your retirement savings.

Choosing the right advisor is crucial. Look for credentials such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These designations indicate a high level of competency and adherence to ethical standards. Don’t hesitate to interview multiple advisors to find one who understands your needs and communicates effectively. Open communication and a clear understanding of their fee structure are essential for a productive advisor-client relationship.