Setting financial priorities is crucial for building a secure financial future. This article explores how to effectively prioritize your finances to achieve your long-term financial goals. Learn how to identify your key financial priorities, create a budget that reflects those priorities, and make informed financial decisions that will serve your future self.

Understand the Difference Between Urgent vs Important

Effectively prioritizing financial goals requires distinguishing between what’s urgent and what’s truly important. Urgent tasks demand immediate attention and often involve short-term consequences. Think paying a bill that’s due tomorrow or fixing a broken appliance. These tasks create a sense of pressure due to their immediacy.

Important tasks, however, contribute to long-term goals and have a significant impact on your overall financial well-being. Examples include saving for retirement, investing, or paying down debt. While these may not have an immediate deadline, neglecting them can have substantial negative consequences in the future.

The key is to not let the urgency of a task overshadow its importance. While addressing urgent matters is necessary, it’s crucial to allocate sufficient time and resources towards important financial goals that build a secure future.

List Your Top 3 Long-Term Financial Goals

Identifying your top three long-term financial goals is a crucial step in effective financial planning. This focused approach helps prioritize resource allocation and provides a clear direction for your financial decisions. Without specific goals, it’s easy to get sidetracked by short-term desires, delaying or even derailing your long-term financial success.

Think about what you truly want to achieve financially. Do you envision early retirement? Perhaps owning a home outright is a major priority. Or maybe building a substantial investment portfolio for future financial security ranks highest. These are just examples, and your goals should be personal and reflect your individual aspirations.

Once you’ve identified your top three goals, write them down. The act of writing solidifies your commitment and creates a tangible reminder of what you’re working towards. This clarity will become invaluable as you make financial decisions, both big and small, guiding you toward a future aligned with your priorities.

Create a Ranking System for Every Expense

Prioritizing expenses is crucial for effective financial management. A ranking system provides a clear framework for making spending decisions aligned with your future goals. This involves categorizing and then ranking each expense based on its importance and necessity.

Start by listing all your monthly expenses. Categorize them into groups like essential needs (housing, food, utilities), financial obligations (debt payments, insurance), future investments (savings, retirement contributions), and discretionary spending (entertainment, dining out).

Next, rank the categories from most to least important. Essential needs should typically rank highest, followed by financial obligations. The position of future investments and discretionary spending will depend on your individual financial goals and current situation. Within each category, prioritize individual expenses. For example, within “food,” groceries should likely take precedence over dining out.

This ranking system acts as a guide when making spending choices. In situations requiring budget adjustments, lower-ranked expenses are the first to be reduced or eliminated. This structured approach ensures that your most essential needs and long-term financial goals are consistently prioritized.

Build a Monthly Budget Around Priorities

Building a monthly budget around your priorities is crucial for achieving your financial goals. This involves more than simply listing income and expenses. It requires a thoughtful examination of your spending habits in relation to what truly matters to you. Begin by listing your essential expenses such as housing, utilities, and food. Then, categorize your remaining spending based on your established priorities. These could include saving for a down payment, paying off debt, or investing for retirement.

Allocate funds to each priority category based on its importance. This might involve making trade-offs. For example, if saving for a down payment is a top priority, you might choose to reduce spending on entertainment or dining out. Using a budgeting app or spreadsheet can help you track your spending and ensure you stay within your allocated amounts for each category.

Regularly review and adjust your budget as needed. Life circumstances and priorities can change, and your budget should reflect these changes. By actively managing your finances and aligning your spending with your priorities, you’ll be well on your way to building a secure financial future.

Say No to What Doesn’t Serve the Bigger Picture

Setting financial priorities requires difficult choices. This often means saying no to immediate gratification or smaller desires in favor of long-term goals. Discipline is key in this process.

Analyze your spending and identify areas where you’re consistently spending money that doesn’t align with your larger financial objectives. Are you frequently eating out when you could be packing lunch? Are you subscribing to multiple streaming services you barely use? These seemingly small expenses can accumulate and derail your progress.

Once you’ve pinpointed these areas, consciously choose to redirect those funds towards your priorities. This might involve setting a stricter budget, automating savings contributions, or finding more affordable alternatives for your regular expenses.

Saying no doesn’t have to be about deprivation. Reframe it as a conscious investment in your future. Every time you choose to save instead of spend unnecessarily, you’re taking a concrete step towards achieving your financial goals. This reinforces positive financial habits and brings you closer to the future you envision.

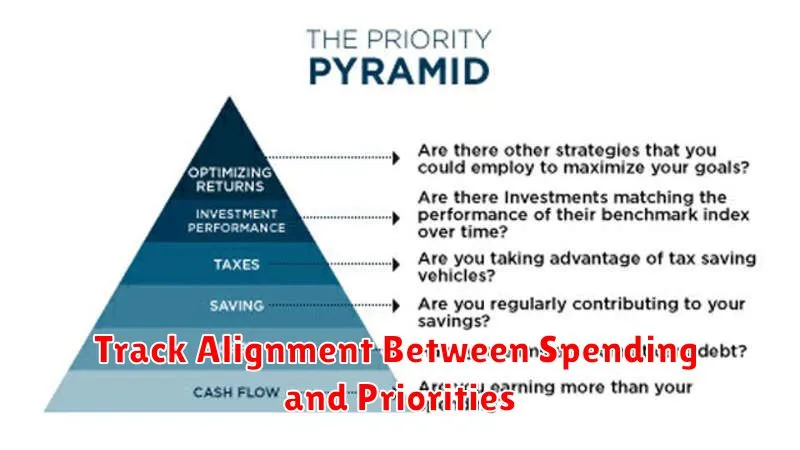

Track Alignment Between Spending and Priorities

Regularly tracking your spending against your established financial priorities is crucial for ensuring you stay on course towards your future goals. This involves more than just budgeting; it requires actively analyzing where your money is going and comparing it to where you intended it to go. This process illuminates the discrepancies between your planned allocation of resources and your actual spending habits.

Begin by categorizing your expenses. Use budgeting apps, spreadsheets, or even traditional pen and paper to track where every dollar is spent. Common categories include housing, transportation, food, entertainment, and savings. Once you have a clear picture of your spending patterns, compare them to the priorities you’ve set. Are you overspending in areas that don’t align with your long-term goals? Are you adequately contributing to your savings or investments?

Identifying misalignments is the first step towards course correction. If your spending doesn’t reflect your priorities, you need to adjust. This may involve reducing spending in certain areas, finding ways to increase your income, or revisiting and refining your priorities themselves. The key is to be honest and objective in your assessment and willing to make necessary changes to ensure your financial actions support your future aspirations.

Review and Re-Prioritize Every 6 Months

Financial priorities aren’t static. Your life changes, and your financial goals should adapt accordingly. Reviewing and re-prioritizing your financial goals every six months allows you to stay on track and adjust to these changes. This regular check-in ensures your efforts remain aligned with your evolving needs and circumstances.

Consider this review a financial tune-up. Are your current priorities still serving you? Perhaps a career change has shifted your income or a new family member has altered your expenses. Maybe you’ve made significant progress on a particular goal, like paying down debt, and it’s time to shift focus to saving for a down payment. This bi-annual review provides the opportunity to make these necessary adjustments.

During your review, honestly assess your progress. Did you meet your milestones? If not, why? What obstacles did you encounter, and how can you overcome them going forward? This process helps you identify areas for improvement and refine your strategies.

Remember, flexibility is key. Don’t be afraid to re-prioritize. Life is unpredictable, and your financial plan should be adaptable. By reviewing and adjusting your priorities regularly, you can ensure your financial plan remains relevant and effective in helping you achieve your long-term objectives.