Building financial security before age 40 is a significant goal for many. Achieving financial independence early allows for greater flexibility and opportunities later in life. This article will outline key steps to build a strong financial foundation before you reach 40, covering topics like budgeting, saving, investing, debt management, and retirement planning, ultimately enabling you to achieve financial freedom and long-term financial security.

Define What Financial Security Means for You

Financial security isn’t a one-size-fits-all concept. It’s a deeply personal state of being. Before embarking on any financial journey, it’s crucial to define what financial security means to you. Does it mean owning a home outright? Having enough invested to retire early? Or simply knowing you can handle unexpected expenses without incurring debt? Your definition will shape your goals and motivate you to achieve them.

Consider your values and lifestyle. Do you prioritize experiences over material possessions? Are you comfortable with a modest lifestyle or do you aspire to a higher standard of living? These factors will influence how much money you need to feel secure. For some, it might mean having six months of living expenses saved. For others, it could involve building a multi-million dollar investment portfolio. There’s no right or wrong answer.

Think about both short-term and long-term goals. Short-term security might involve paying off high-interest debt or building an emergency fund. Long-term security could involve saving for retirement, a child’s education, or a down payment on a house. Defining these goals will provide a roadmap to achieving financial security based on your unique needs and aspirations.

Regularly reassess your definition. As your life changes, so too will your financial needs and priorities. Marriage, children, career changes, and other life events can all impact your sense of financial security. Make it a habit to revisit your definition periodically to ensure it remains aligned with your current circumstances and long-term vision.

Start Saving for Emergencies Early

Building a strong financial foundation starts with preparing for the unexpected. Emergency funds are crucial, acting as a safety net against unforeseen expenses like medical bills, job loss, or car repairs. Starting early, even with small amounts, allows the power of compounding to work in your favor.

Aim to accumulate three to six months’ worth of essential living expenses. Essential expenses include rent or mortgage payments, utilities, groceries, and transportation. Calculate this amount and establish a dedicated savings account specifically for emergencies.

Automate your savings by setting up regular transfers from your checking account to your emergency fund. Even small, consistent contributions add up over time. Treat these savings as non-negotiable, prioritizing them as you would any other essential bill.

As your income grows, periodically reassess your emergency fund target and adjust contributions accordingly. Life changes, such as starting a family or buying a home, often require a larger financial cushion.

Eliminate High-Interest Debt Aggressively

High-interest debt, such as credit card debt, can significantly hinder your journey to financial security. It’s crucial to prioritize paying it down as aggressively as possible. The longer you carry high-interest balances, the more you’ll pay in interest, delaying your progress towards other financial goals.

Consider the debt avalanche method. List your debts from highest interest rate to lowest. Make minimum payments on all debts, then allocate any extra funds towards the debt with the highest interest rate. Once that debt is eliminated, move on to the next highest, creating a snowball effect.

Alternatively, the debt snowball method can provide a psychological boost. List your debts from smallest balance to largest. Make minimum payments on all debts, then focus extra payments on the smallest balance. The satisfaction of quickly eliminating a debt can motivate you to continue the process.

Explore options to lower your interest rates. Balance transfer cards with introductory 0% APR periods can offer temporary relief, but be mindful of transfer fees and ensure you can pay off the balance before the promotional period ends. Negotiating a lower rate with your current creditors is also worth considering.

Budgeting and spending awareness are essential. Track your expenses to identify areas where you can cut back and free up more cash to put towards debt repayment. Every dollar saved is a dollar closer to financial freedom.

Invest in Low-Risk, Long-Term Instruments

Building long-term financial security requires a strategic approach to investing. Prioritizing low-risk investments designed for the long haul offers stability and consistent growth, mitigating potential losses while maximizing returns over time. This approach is particularly crucial for those aiming to establish a secure financial foundation before age 40.

Consider options like index funds, which offer diversified exposure to the market with lower expense ratios compared to actively managed funds. Bonds, especially government bonds, provide a stable, fixed-income stream, albeit with generally lower returns than stocks. Real estate, while requiring a larger initial investment, can appreciate significantly over time and generate rental income.

Diversification within your low-risk portfolio is essential. Spread your investments across different asset classes to minimize the impact of market fluctuations on your overall portfolio. This balanced approach is key to achieving sustainable growth and mitigating potential risks.

While the potential for high returns might be tempting, focusing on slow, steady growth through low-risk, long-term investments offers a more reliable path to financial security, especially when time is on your side. This strategy allows your investments to compound over the years, creating a solid foundation for a secure financial future.

Diversify Income with Side Hustles or Passive Streams

Building financial security before 40 requires more than just saving from your primary income. Diversifying your income streams is crucial. This can involve pursuing a side hustle or developing passive income sources.

Side hustles offer a direct way to increase your earnings. Consider skills you possess that could translate into freelance work, consulting, or a small business. Examples include writing, graphic design, web development, tutoring, or driving for ride-sharing services. The extra income generated can accelerate debt repayment, boost savings, and create a financial buffer.

Passive income involves earning money with minimal ongoing effort. While it often requires upfront work to establish, the potential for long-term returns is significant. Examples include creating and selling online courses, writing an ebook, investing in dividend-paying stocks, or renting out a property. Building passive income streams takes time and dedication, but can significantly contribute to long-term financial stability.

Choosing between a side hustle and passive income depends on your individual circumstances, skills, and goals. A side hustle provides immediate income but requires active participation. Passive income necessitates more initial effort with potentially delayed gratification, but can eventually generate income with minimal ongoing work. Ideally, a combination of both can provide both short-term gains and long-term financial security.

Track Net Worth Growth Year by Year

Tracking your net worth annually is a critical step in building financial security. It provides a clear picture of your financial progress and helps you identify areas for improvement.

Calculate your net worth by subtracting your total liabilities (debts) from your total assets (what you own). Assets include items like cash, investments, and property. Liabilities include mortgages, student loans, and credit card debt.

Record your net worth calculation at the same time each year, ideally annually. This consistency allows for accurate year-over-year comparisons. Analyze the changes in your net worth. Is it growing steadily? Are there any significant fluctuations? Understanding these trends helps you adjust your financial strategies accordingly.

Use a spreadsheet or a personal finance app to track your net worth over time. This creates a visual representation of your progress and makes it easier to identify long-term patterns. Consistent monitoring empowers you to make informed decisions and stay on track towards financial security.

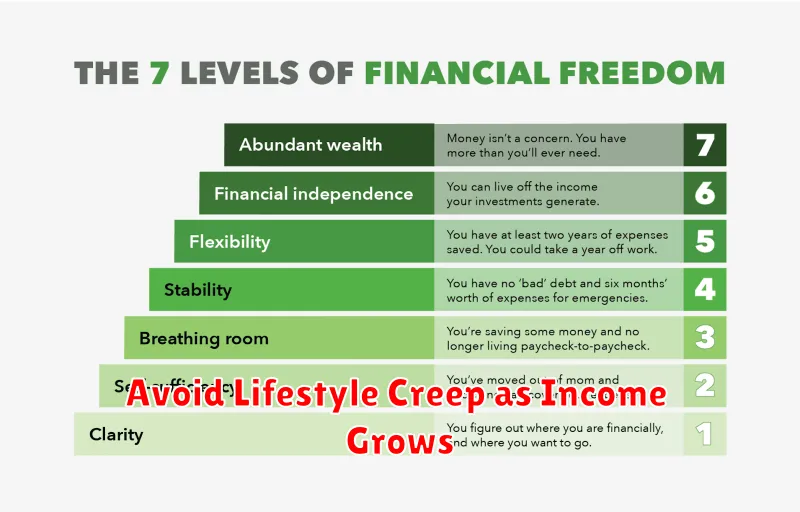

Avoid Lifestyle Creep as Income Grows

Lifestyle creep, also known as lifestyle inflation, is the tendency to increase spending as income rises. This can significantly hinder your ability to build financial security, especially before age 40. As you earn more, it’s tempting to upgrade your car, move to a bigger house, or indulge in more frequent luxuries. While enjoying the fruits of your labor is important, uncontrolled lifestyle creep can quickly derail your long-term financial goals.

One of the most effective ways to combat lifestyle creep is to establish a budget and track your expenses. By understanding where your money is going, you can identify areas where you might be overspending and make conscious choices about how to allocate your increased income. Prioritize saving and investing a portion of every raise, treating it as a non-negotiable expense.

Set clear financial goals, such as a down payment on a house, early retirement, or building an emergency fund. These goals will serve as motivation to resist impulsive spending and keep your finances on track. Visualizing your future and the security it brings can help you stay focused on the bigger picture, rather than getting caught up in immediate gratification.

Differentiate between needs and wants. A new car might be nice, but is it truly necessary? Be honest with yourself about your spending habits and evaluate whether purchases are adding real value to your life or simply satisfying a temporary desire. Often, a less expensive option can fulfill the same need without impacting your financial security.

Finally, remember that building wealth takes time and discipline. Delayed gratification is a key principle in achieving long-term financial security. While enjoying your current income is important, making conscious choices about how you spend and save will pay off significantly in the long run, allowing you to build a more secure financial future before age 40.