Planning your finances for the next 10 years can feel daunting, but with the right approach, it can be an empowering journey towards financial security and achieving your long-term goals. This guide will provide you with a comprehensive framework for financial planning, covering key aspects like budgeting, saving, investing, debt management, and retirement planning. Whether you’re looking to buy a house, start a family, or simply secure your future, understanding how to plan your finances over the next decade is crucial for success. We’ll delve into strategies for long-term financial planning, offering practical advice and actionable steps to help you build a solid foundation for your financial future over the next 10 years.

Visualize Where You Want to Be in a Decade

Financial planning requires a clear vision of your future. Imagine your life in 10 years. Where do you want to live? What do you want to be doing? Do you envision owning a home, starting a family, or traveling the world? The more specific you can be, the better you can tailor your financial plan to achieve these goals.

Consider your career aspirations. Do you see yourself climbing the corporate ladder, starting your own business, or transitioning to a different field? These choices significantly impact your earning potential and should be factored into your long-term financial strategy.

Think about your lifestyle preferences. Do you prioritize experiences over material possessions? Do you prefer city living or a quieter life in the suburbs? Understanding your values will help you determine how much money you need to save and how you want to allocate your resources.

This visualization exercise isn’t just about daydreaming. It’s about setting concrete goals and connecting them to financial milestones. By visualizing your desired future, you can create a roadmap to guide your financial decisions for the next 10 years.

Break Down Goals Into 1-Year Segments

A 10-year financial plan can feel overwhelming. To make it more manageable, break it down into smaller, one-year segments. This allows for adjustments and keeps you focused on achievable milestones.

Each year should have specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, instead of a broad goal like “save for retirement,” a one-year goal might be “contribute $5,000 to my retirement account.” This provides a clear target and allows you to track your progress effectively.

Review your one-year goals annually. Life changes, and your financial plan should adapt. By evaluating and adjusting each year, you can ensure your long-term plan remains relevant and achievable.

Breaking down your 10-year plan into annual segments facilitates planning and execution. This approach provides the flexibility to adapt to unforeseen circumstances while maintaining a clear path toward your long-term financial objectives.

Set Financial Priorities (Savings, Debt, Investment)

A crucial step in 10-year financial planning involves prioritizing your financial goals. This typically encompasses balancing savings, managing debt, and making smart investments. Establish a clear hierarchy for these three key areas.

Savings: Building a solid financial foundation begins with saving. Determine your emergency fund goal, aiming for 3-6 months of living expenses. This safety net provides a buffer against unexpected events. Simultaneously, earmark savings for specific short and long-term goals, such as a down payment on a house or retirement.

Debt: High-interest debt can significantly hinder your long-term financial progress. Prioritize paying down high-interest debt, like credit cards, as quickly as possible. Consider strategies like the debt avalanche or snowball method. Once high-interest debts are managed, focus on lower-interest debts like student loans or mortgages.

Investment: Once you have a comfortable emergency fund and are managing your debt effectively, turn your attention to investing. Determine your risk tolerance and explore various investment vehicles like stocks, bonds, and mutual funds. Consider diversifying your investments to mitigate risk and maximize potential returns. Long-term investing is key to building wealth over a 10-year horizon. Aligning your investments with your overall financial goals and risk tolerance is essential.

Create a Master Plan Using Templates

Developing a comprehensive financial plan for the next decade can feel overwhelming. Using templates can significantly simplify this process. Templates provide a structured framework, guiding you through key financial aspects and ensuring you don’t overlook critical elements.

Numerous financial planning templates are available online or through financial advisors. Choose a template that aligns with your specific needs and goals, whether it’s retirement planning, debt reduction, or wealth building. Key features to look for in a template include sections for budgeting, saving, investing, and debt management.

Customizing the template to your unique circumstances is crucial. Input your current financial data, including income, expenses, assets, and liabilities. Then, project your anticipated financial changes over the next 10 years, such as salary increases, potential investment growth, and major life events like buying a house or starting a family.

A robust template will offer tools and calculators to help you analyze different scenarios. For example, you can explore the impact of increasing your retirement contributions or paying off your mortgage early. This analysis allows you to make informed decisions and adjust your plan as needed.

Regularly review and update your financial plan. Annual reviews are recommended, but more frequent updates may be necessary if your financial situation changes significantly. Using a template makes this ongoing monitoring and adjustment much more manageable.

Build in Flexibility for Life Events

Life rarely follows a perfectly laid-out plan. Over the next 10 years, expect both anticipated and unexpected events. Marriage, children, career changes, health issues, or even a global pandemic can significantly impact your finances. Flexibility is crucial to navigate these changes successfully.

Build an emergency fund to cushion against unexpected job loss, medical expenses, or home repairs. Aim for 3-6 months of essential living expenses. This fund allows you to address emergencies without derailing your long-term financial goals.

Consider a “life happens” fund for anticipated but irregular expenses. This fund is separate from your emergency fund and covers expenses like a new car, a down payment on a house, or continuing education. Predicting these expenses and saving for them strategically reduces financial stress when they arise.

Avoid rigid, overly-detailed plans. While setting clear goals is essential, build in room for adjustments. Regularly review and revise your financial plan, at least annually, to ensure it aligns with your current circumstances and evolving goals. This allows you to adapt to life’s unexpected turns and stay on track towards long-term financial security.

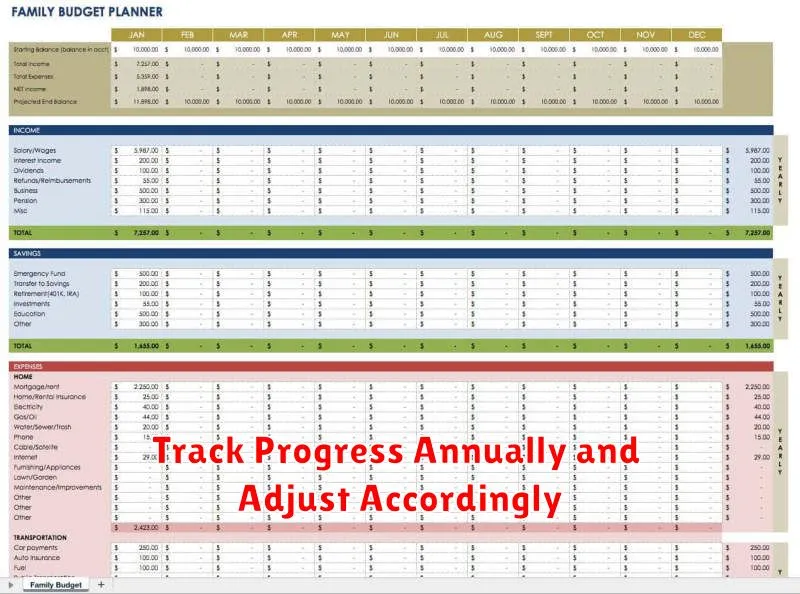

Track Progress Annually and Adjust Accordingly

A ten-year financial plan isn’t a static document. It requires regular review and adjustments to stay relevant and effective. Annual progress tracking is crucial to ensuring you remain on course towards your long-term goals.

Each year, take time to assess your financial performance against your planned milestones. Did you achieve your savings targets? Were your investment returns in line with expectations? Did any unexpected expenses or life changes occur that impact your financial situation?

Based on this assessment, adjust your plan accordingly. If you’re ahead of schedule, you might consider accelerating your savings or investments. If you’ve fallen behind, you might need to reassess your budget, reduce expenses, or adjust your investment strategy. Life changes, such as marriage, having children, or career changes, will also necessitate adjustments to your financial plan.

This annual review and adjustment process allows you to adapt to changing circumstances and remain flexible in pursuing your long-term financial objectives. It ensures that your plan remains a dynamic tool guiding your financial decisions over the next decade.

Celebrate Long-Term Milestones Without Overspending

Reaching a significant milestone deserves celebration, but it shouldn’t derail your long-term financial plan. Budgeting for these events is key. Consider setting up a separate savings fund specifically designated for milestone celebrations. This allows you to anticipate costs and save appropriately, avoiding impulsive spending and accumulating debt.

Prioritize which milestones truly warrant larger celebrations. Not every anniversary or birthday requires an extravagant affair. Consider alternative, more cost-effective ways to mark these occasions, such as intimate gatherings with close friends and family or experiences rather than material gifts.

When planning your celebration, explore creative ways to save. Consider hosting at home, choosing off-peak seasons for travel, or opting for potluck-style meals. These small adjustments can significantly reduce costs without sacrificing the joy of the occasion.

Remember, celebrating a milestone is about marking the achievement, not the expenditure. By planning ahead and making mindful choices, you can create memorable experiences without jeopardizing your long-term financial goals.