Creating a long-term budget is crucial for achieving your financial goals, whether it’s buying a home, retiring comfortably, or simply gaining control of your finances. This guide provides a comprehensive, step-by-step approach to building a sustainable budget that you’ll actually follow, covering everything from tracking expenses and setting realistic goals to automating savings and adapting to unexpected changes. Learn how to develop a long-term budget that works for you, empowering you to take control of your financial future and build long-term financial stability.

Understand the Difference Between Monthly and Long-Term Budgets

While both are essential for financial health, monthly and long-term budgets serve distinct purposes. A monthly budget focuses on your short-term cash flow, tracking income and expenses within a single month. It helps ensure you’re covering your immediate bills and living within your means on a month-to-month basis. It allows for adjustments based on variable monthly expenses.

A long-term budget, often spanning a year or several years, looks at the bigger financial picture. It incorporates larger financial goals, like saving for a down payment, paying off debt, or investing for retirement. It provides a roadmap for achieving these goals by allocating resources over an extended period. While less detailed than a monthly budget regarding specific daily expenses, it provides the framework for major financial decisions and helps prioritize long-term objectives.

The key difference lies in the time horizon and the level of detail. Monthly budgets are detailed and short-term, while long-term budgets are broader and focus on long-term goals and planning. Think of your monthly budget as a tactical tool for managing daily finances and your long-term budget as a strategic guide for achieving your financial aspirations.

Break Annual Goals Into Monthly Budgets

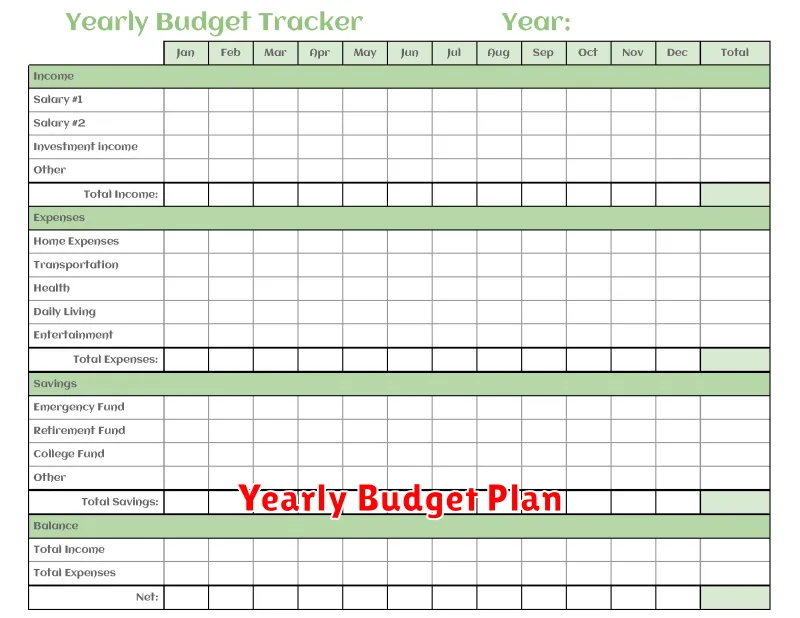

A long-term budget requires breaking down your annual financial goals into manageable monthly budgets. This allows you to track progress and make necessary adjustments throughout the year. Start by identifying your key annual goals, such as saving for a down payment, paying off debt, or investing a certain amount.

Next, divide the total amount needed for each goal by 12 to determine your monthly target. For example, if you aim to save $12,000 for a down payment in a year, your monthly saving target would be $1,000. This process creates a clear roadmap for achieving your larger financial objectives.

Factor in seasonal expenses when creating your monthly budgets. Certain months might have higher costs, such as holidays or back-to-school shopping. Anticipating these fluctuations helps you avoid overspending and maintain progress toward your annual goals.

Regularly review your monthly budgets and compare them to your actual spending. This allows you to identify areas for improvement and ensure you stay on track. If you find yourself consistently overspending in a particular category, consider adjusting your budget or exploring ways to reduce expenses.

By breaking your annual goals into monthly budgets, you create a practical and actionable plan. This approach promotes consistency and increases the likelihood of achieving your long-term financial objectives.

Include Periodic and Irregular Expenses

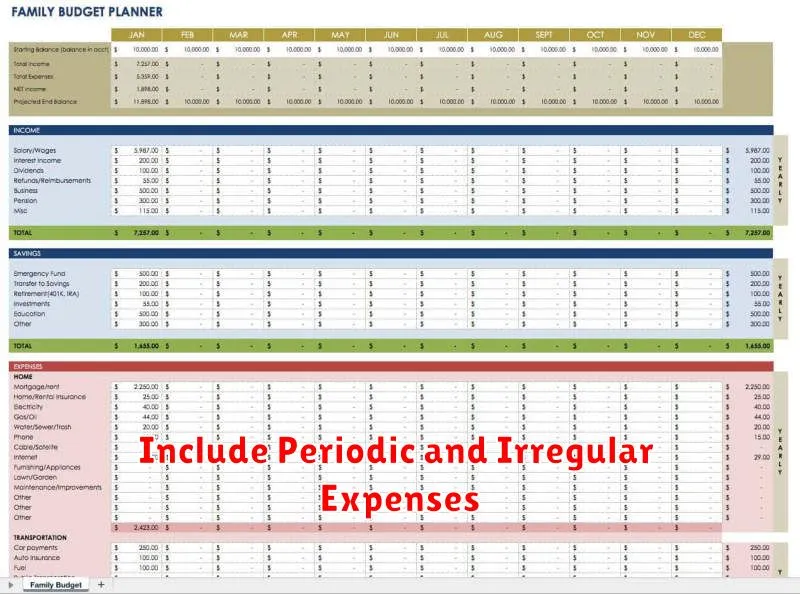

A long-term budget must account for expenses that don’t occur monthly. These periodic expenses might include annual car insurance premiums, quarterly property taxes, or semi-annual life insurance payments. Failing to account for these can lead to budget shortfalls when they come due.

Similarly, irregular expenses, such as car repairs, home maintenance, or medical bills, can disrupt a budget if not planned for. While predicting the exact amount and timing of these expenses is challenging, setting aside a monthly amount in a designated “irregular expense” fund can help absorb their impact.

Accurately estimating periodic and irregular expenses involves reviewing past spending, considering potential future needs, and building in a buffer for unexpected costs. This allows for greater financial stability and prevents these essential expenses from derailing your long-term budget.

Use Budgeting Apps with Yearly View Options

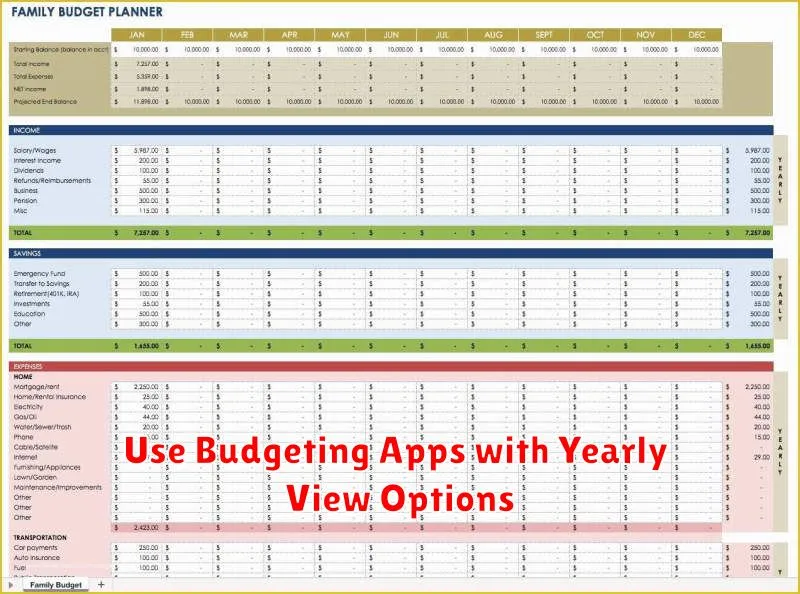

Managing finances effectively requires a long-term perspective. While monthly budgeting is essential, a yearly view provides crucial insights into your overall financial health and progress towards larger goals. Budgeting apps with yearly view options offer a powerful tool to achieve this.

These apps allow you to input your projected income and expenses for the entire year. This big-picture perspective helps identify potential shortfalls or surpluses well in advance, allowing you to make necessary adjustments to your spending habits or savings strategies.

A yearly view also facilitates long-term financial planning. Whether saving for a down payment, planning for retirement, or managing debt, seeing your finances on a yearly scale allows you to track progress and stay motivated.

Many apps offer features like customizable categories and spending trackers that provide a granular view of your finances, even within the yearly overview. This level of detail helps pinpoint areas where you can optimize your spending and maximize your savings.

By utilizing the yearly view option in budgeting apps, you can shift from reactive monthly budgeting to proactive financial management, setting yourself up for long-term financial success.

Review Quarterly to Track Progress

Creating a long-term budget isn’t a “set it and forget it” endeavor. Regular review is crucial for maintaining control and ensuring your financial plan remains aligned with your goals. A quarterly review provides a good balance between staying engaged and avoiding burnout from overly frequent checks.

During your quarterly review, compare your actual spending against your budgeted amounts. Identify any significant variances. Did you overspend in any categories? Were there unexpected expenses or income changes? Analyzing these discrepancies will offer valuable insights into your spending habits and help you make necessary adjustments.

This review process also allows you to assess the effectiveness of your budget. Are your savings goals on track? Do you need to adjust your spending or saving targets based on life changes or shifting financial priorities? Perhaps you’ve received a raise, or decided to purchase a home. These milestones require budget revisions to reflect your evolving financial situation.

Finally, use this time to reaffirm your long-term financial goals. Are you still working towards the same objectives? Has anything changed that necessitates a shift in your priorities? Regularly reminding yourself of your “why” can help you stay motivated and committed to following your budget.

Stay Motivated with Visual Goals and Charts

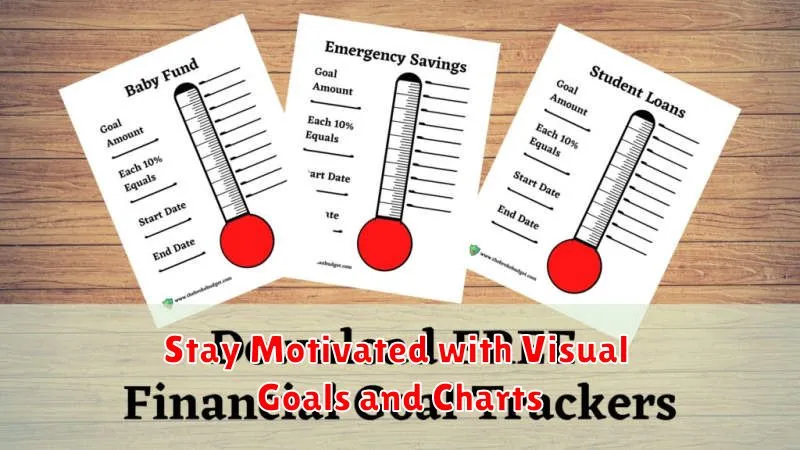

Maintaining motivation over the long term with budgeting requires more than just willpower. Visual aids can significantly impact your ability to stay on track and engaged with your financial progress.

Charts and graphs transform abstract numbers into tangible representations of your efforts. Seeing a rising savings line or a shrinking debt bar can be powerfully motivating. Consider using spreadsheet software or budgeting apps to automatically generate visuals of your income, expenses, and progress towards your goals.

A visual representation of your goals, such as a dream vacation or a down payment on a house, can also serve as a constant reminder of what you’re working towards. Place these visuals in prominent locations to reinforce your commitment to your budget.

Regularly review your charts and update your visual reminders. This will help you stay focused, assess your progress, and make adjustments to your budget as needed.

Simplify Categories to Avoid Overwhelm

A long-term budget requires a sustainable approach. Too many categories can make budgeting feel overly complicated and discourage consistent tracking. Simplify your categories to make the process manageable.

Instead of highly specific categories like “Dining Out – Breakfast,” “Dining Out – Lunch,” and “Dining Out – Dinner,” consolidate them into a single “Dining Out” category. This reduces the mental burden of tracking and allows you to see the bigger picture of your spending habits.

Focus on the major spending areas: Housing, Transportation, Food, Utilities, Debt Repayment, and Savings. Within these broader categories, you can create subcategories if necessary, but avoid excessive detail. For instance, “Housing” might include rent or mortgage, property taxes, and home insurance.

Regularly review your categories and adjust as needed. You may find that some categories are too broad and require further breakdown, while others can be merged for simplicity. The key is to find a balance that provides useful information without feeling overwhelming.